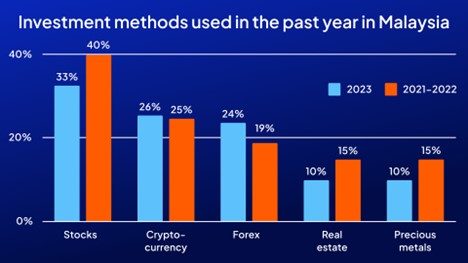

A recent study conducted by international broker OctaFX reveals a striking shift in Malaysia’s investment landscape. Traditional investment assets such as stocks and precious metals have experienced a decline in interest in 2023. Meanwhile, Forex and cryptocurrencies have seen a marked increase, demonstrating resilience against economic downturns and prevailing as appealing investment alternatives.

Rising Spending Rates Amidst Economic Instability

In a world still grappling with the repercussions of the pandemic, 2023 has posed significant challenges for investors, especially in the Western nations. Central banks have increased interest rates in response to surging demand, leading to a decline in asset values. This scenario has catalysed a shift from saving to spending among Malaysians.

Fitch Solutions’ note on 11 July highlighted an anticipated increase of 5% in spending rates for 2023, peaking at RM1.1 trillion, equivalent to RM866.6 billion at 2010 prices. This followed an 11.8% increase in real spending rates in the previous year, further intensifying the trend away from traditional investment assets.

Shift from Traditional Investment Assets

OctaFX’s study underscores the changing dynamic within Malaysia’s economic activities, as the focus shifts toward spending. Traditional assets, including stocks, real estate, and precious metals, have seen a 5–7% decrease in interest.

Gero Azrul, a financial markets analyst at OctaFX, explains, “This trend is common during periods of high inflation and strict economic policies implemented by central banks. Individuals often divert from investments to purchase tangible assets as a way to ‘invest’ their money. Additionally, the post-pandemic environment has triggered a surge in expenditure for travel and entertainment as people resume their normal activities.”

Cryptocurrency and Forex – The New Safe Havens

Despite the overall shift away from conventional investment assets, the OctaFX study revealed an exceptional trend. Both cryptocurrency and Forex demonstrated a growth rate of 1% and 5% respectively in 2023.

Gero Azrul notes, “Since 2021, we’ve seen a strong correlation between Forex and cryptocurrency investments. These forms of investment are becoming safe havens during times of high inflation and strict economic policies due to their relative resilience.”

With Bank Negara Malaysia likely to halt interest rate hikes and as the world enters a new business cycle, Azrul predicts a revival in investment interest. While Forex and cryptocurrencies are anticipated to maintain their appeal, traditional investment assets may recover some ground due to their demonstrated ability to weather economic downturns.

Also read: Unfolding the 15th National Real Estate Awards: A Testament to Resilience and Excellence in Malaysian Property Sector

About OctaFX

OctaFX, an international broker operating since 2011, provides online trading services to clients across 180 countries and has opened over 40 million trading accounts. Known for its commission-free access to financial markets, OctaFX offers free educational webinars, articles, and analytical tools to assist clients in achieving their investment goals. Additionally, the company engages in numerous charitable and humanitarian initiatives worldwide.

In the APAC region, OctaFX received the ‘Best Forex Broker Malaysia 2022’ award from the Global Banking and Finance Review and the ‘Best Global Broker Asia 2022’ from the International Business Magazine.