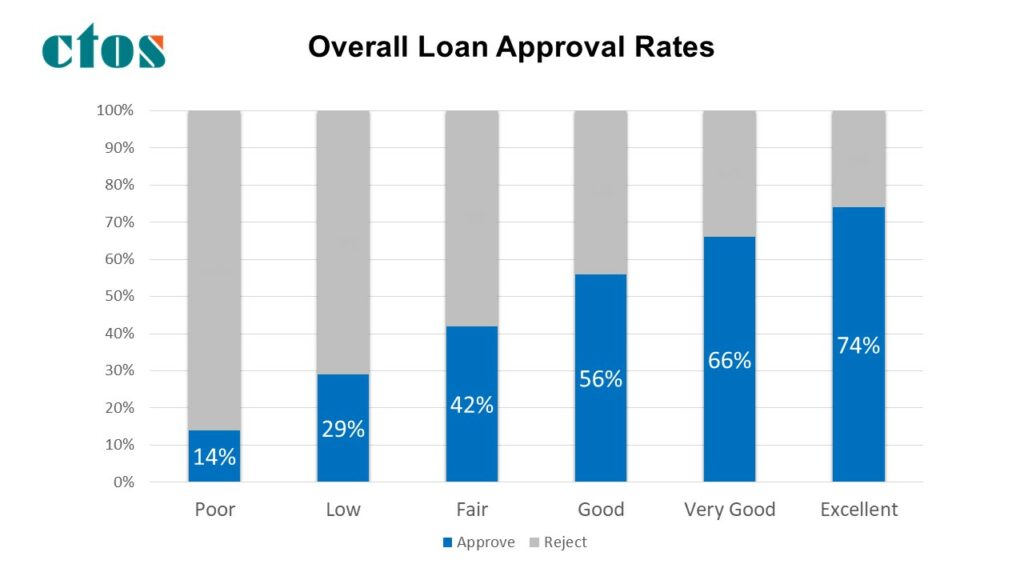

CTOS, Malaysia’s leading credit reporting agency, has released a summary of findings regarding the correlation of consumers’ MyCTOS Scores against their chances of securing loan financing. Using a sample of over 250,000 applications for financing within one month of the MyCTOS Score report being checked, the study highlights the disparity in loan approval rates between the various CTOS score categories.

“Access to credit is a practical necessity today. Much more than a means to make purchases, credit enables people to meet everyday needs like housing and modes of transport, and improves their standard of living,” explained Erick Hamburger, Group CEO of CTOS Digital Berhad. “Being in a position to know how likely you are to be able to access credit is very important to understanding your own personal financial health.”

The study showed that overall, those consumers with an ‘excellent’ CTOS score, were five times more likely to have their credit applications approved, compared to those with the lowest CTOS Scores.

For secured credit applications, such as auto loans and home loans, approval rates varied, even though lenders have an asset to secure the loan against. However, those with the best CTOS Scores had 74% approval rates for auto loans, and 61% approval rates of mortgages. At the other end of the scale, those with the lowest CTOS score had just a 9% chance of securing their car with a loan, and 22% approvals for mortgages.

The largest disparity between those with the highest and lowest credit scores comes from credit card applications. Consumers with a ‘poor’ CTOS Score only had a 10% chance of being approved for a credit card, while those with an ‘excellent’ score had an approval rating of 76%.

“It is well known that better credit scores equate to higher approval levels, however this is the first time that we have been able to quantify this with real data,” continued Erick Hamburger. “It should also be noted that a better credit score does not only increase credit application approval chances, but also gives borrowers access to better interest rates, and better rewards, making it cheaper for consumers to borrow funds both in the short and long term. By strengthening their financial management skills and along with it, their credit scores, consumers will find it much easier to navigate financial decisions with increased credit options. However, it should be noted that CTOS isn’t involved in any lending decisions made by lenders nor do we offer any opinion on a person’s creditworthiness as financial institutions make their own decisions using the information available to them, including CCRIS Reports furnished by BNM, information provided by the customer in credit application documents, and other supporting documents.”

The MyCTOS Score Report contains critical information that enable financial institutions to assess an individual’s creditworthiness, including their CTOS Score , CCRIS records, litigation and bankruptcy information, directorship and business interest based on Companies Commission of Malaysia (SSM), and trade reference listings (eTR) that detail the past payment experience to non-financial institutions such as CTOS’ subscribers.

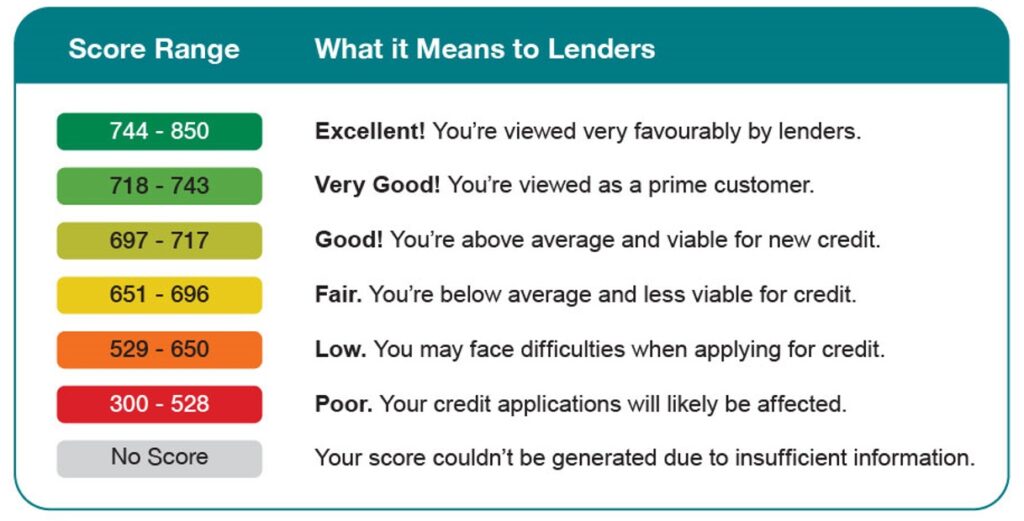

Five factors make up the 3-digit number of the CTOS Score – payment history, amount owed, credit history length, credit mix and new credit application. Once all these factors are accounted for, a 3-digit CTOS Score which ranges from 300 to 850 provides a numerical representation of a person’s credit worthiness.

For more details, or to check your own CTOS Score, visit www.ctoscredit.com.my