- Regional rents fall 3.1% year-on-year, a slight improvement from Q1

- Regionwide vacancy rate stabilises at 14.8%, halting an upward trend

- Kuala Lumpur records the highest vacancy rate in the region at 28.7%, reflecting ongoing challenges in the local market

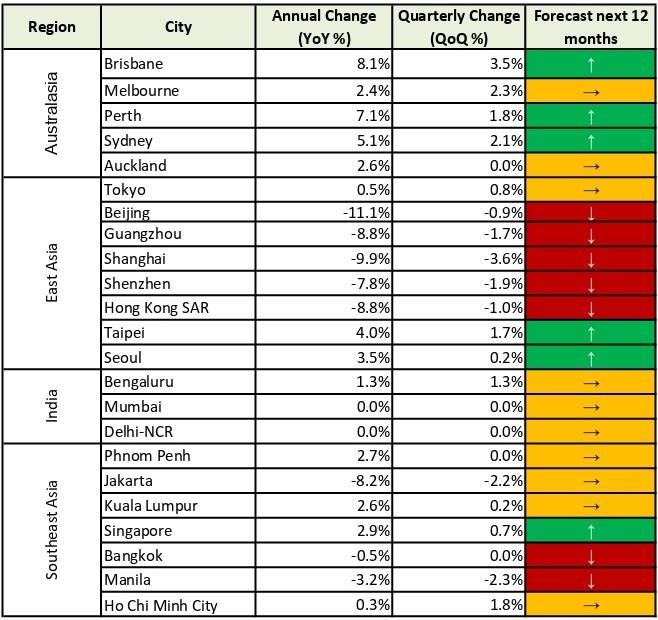

Global property consultancy Knight Frank’s Asia-Pacific Prime Office Rental Index for Q2 2024 shows a 3.1% year-on-year decline in regional prime office rents, marking a marginal improvement from the 3.2% drop in Q1. Although this extends the downward trend to eight consecutive quarters, the slight stabilisation suggests that the regional office sector may be approaching a turning point amidst ongoing challenges.

Key highlights

- Fifteen of the 23 cities tracked reported stable-to-increasing rents year-on-year, unchanged from Q1 2024.

- Brisbane led rental growth with an 8.1% year-over-year increase.

- Regionwide vacancy rate stabilised at 14.8%, halting an upward trend ongoing since Q3 2022.

- Jakarta’s vacancy rate grew over 30%, the only exception in Southeast Asia.

- Mumbai’s office leasing volume rose 183.1% year-on-year.

- The APAC office market will continue to favour tenants in 2024, with the vacancy rates expected to trend upwards.

Chinese Mainland cities led the fall, with rents decreasing 10.8% year-on-year, slightly steeper than the 10% reduction seen in Q1 2024. The deepening downturn indicates worsening market conditions in these areas, largely due to an oversupply of office space and economic uncertainties.

While the overall trend remains downward, 15 of the 23 monitored cities reported stable or increasing rents year-on-year, mirroring the figures from Q1 2024. This resilience in select markets suggests that some areas are weathering the regional challenges more effectively. Additionally, the regional vacancy rate stabilised at 14.8%, halting an upward trend that had persisted since Q3 2022, indicating a potential leveling off in the market.

Knight Frank’s Asia-Pacific Prime Office Rental Index for Q2 2024 indicates a positive forecast for Kuala Lumpur’s prime office rents over the next 12 months. The data shows a 2.6% year-on-year increase in rents, alongside a 0.2% quarterly rise, suggesting a stable and healthy outlook for the local market. The forecast suggests that the office rental market in Kuala Lumpur is expected to remain stable, reflecting a balanced environment. This stability is a positive sign for investors and businesses looking for continuity in their real estate decisions.

Teh Young Khean, executive director of office strategy & solutions, Knight Frank Malaysia, said “We continue to see strong and active inquiries from the ground, including sectors such as tech, professional services, insurance, global business services (GBS), oil and gas, as well as banking and finance. Along with some take-ups in prime offices within the KL Fringe submarket, rental and occupancy rates are expected to improved, indicating a positive outlook for the market.”

Tim Armstrong, global head of occupier strategy and solutions, said, ” The current trend reflects a business cycle downturn. Major office sectors such as finance and technology continue to downsize staff strength amid ongoing uncertainty in the business environment. This selective approach will likely keep demand for office spaces restrained. Lease renewals will remain popular, while companies may also consider consolidating their office spaces due to falling rents prompting a flight-to-quality move. No doubt, occupiers face a slate of competing factors, balancing the new office culture and ESG objectives against business considerations. Despite reduced capital expenditure, occupiers are encouraged to remain aware of the region’s ample supply pipeline to explore quality options and capitalise on current conditions by securing favourable rates, given that new supply is expected to tighten due to high interest rates impacting future construction.”

In the Chinese Mainland, office absorption improved as landlords prioritised occupancy over rental rates. Beijing emerged as a prime beneficiary of this strategy, with supportive policies for the tech sector and leasing activity from state-owned enterprises driving increased demand. Companies such as ByteDance and Huawei capitalised on these favourable conditions to secure substantial office spaces.

Christine Li, head of research, Asia-Pacific, said “Landlords prioritising occupancy levels in Chinese Mainland markets have continued to exert downward pressure on rents in the region. With the pace of decline picking up faster, the search for a bottom in these markets still has some way to go. While conditions are tenant-favourable, rental growth trajectories have diverged across the region. Asset and location elements are bucking regional trends; the rental uplift in Australian markets and Ho Chi Minh City show occupiers still prefer quality and ESG-accredited spaces. The interaction between economic forces and occupier ambitions means conditions will remain nuanced. Occupiers will have to pursue a varied portfolio management strategy to optimise their regional footprint.”

Amid regional challenges, Indian markets stand out with strong leasing fundamentals fueled by strong demand from offshoring operations and domestic businesses. In Q2 2024, Mumbai’s office leasing volume continued its upward trend with approximately 0.28 million sq m (3.0 million sq ft) of space leased—an impressive 183.1% year-on-year increase. Mumbai and Bengaluru have emerged as standout cities, experiencing a consistent upward trend since late 2023.

The Asia-Pacific prime office sector is expected to remain tenant-favourable in 2024, with over 11 million square meters of prime stock set for delivery, 60% of which will be in Chinese Mainland markets. Landlords will likely maintain accommodative strategies to sustain occupancies, while occupiers focus on lease renewals amidst economic uncertainty. As demand continues to lag, region-wide vacancies are expected to remain elevated, with subdued rent growth for the remainder of 2024.

Forecast for the next 12 months:

Read the full report here.