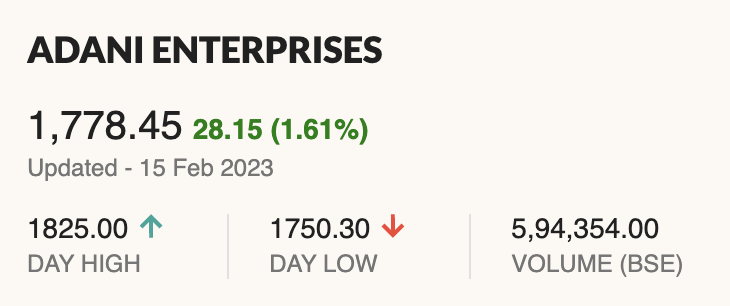

Despite the allegations levied against it by US short-seller Hindenburg, Adani Enterprises – the prominent firm of the Adani Group – reported a profit of Rs 820 crore in its Q3 fiscal year 2022-23. This is a testament to their resilience and determination. A surge in the coal trading business, combined with the success of its new energy ventures, led to the remarkable results.

In the corresponding quarter of last year, the firm had posted a net loss of Rs 11.6 crore. Additionally, Adani New Energy saw an increase in both volumes and prices of solar modules while Coal Trading Division’s volumes and prices rose significantly. The EBITDA for the coal trading business skyrocketed four times its prior value, and the Adani New Energy division more than doubled in size.

Gautam Adani, Chairman of the Adani Group, highlighted the organisation’s incredible perseverance and success in developing immensely profitable core sector businesses. He calmed investors by reassuring that the current market instability is only a short-term issue and Adani Enterprises would still be concentrating on limiting leverage & pursuing growth opportunities.

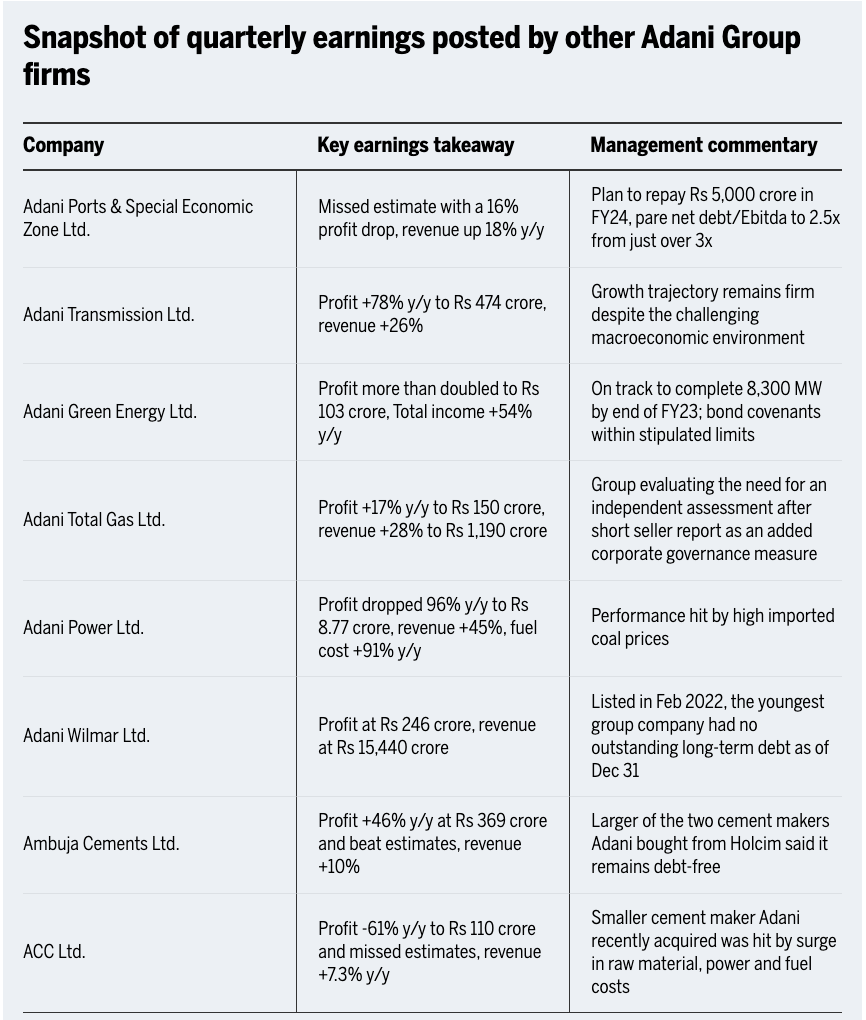

Adani Enterprises reported some positive earnings, signifying the strength of its multiple business ventures- ranging from coal mining to airports, data centers, digital services and metals. Despite a few issues recently, such as the halted $2.5 billion share sale and plummeting stock values, Adani Enterprises has refused Hindenburg’s claims and provided an answer to the stock markets.

Also Read Uncovering the Truth Behind Hindenburg Research: Is it a Legitimate Research Firm or a Short-Selling Looters?

Owing to the volatile market conditions, the company chose to call off its fully subscribed follow-on public offer and instead released the entire amount of its offer. Adani Enterprises clarified that their financial results for the quarters and nine months ending December 31, 2022, did not require any material amendments in response to the allegations made by Hindenburg.