Capital markets have been full of people who try to crash a company’s stock to make money for a long time. But what’s interesting is that a group of people who make their living through unethical practises like short selling have recently made accusations against the Adani conglomerate. Nathan Anderson started Hindenburg Research. In recent years, he has become well-known for his analysis that causes stock prices to drop. Anderson is thought to be a blackmailer who has destroyed many top companies that were important to a country’s growth. The rest of the world thinks of the United States as a place where unethical businesses and fraud companies thrive causing a lot of bubbles like subprime crisis, and Hindenburg Research is no different.

The latest person of interest for Hindenburg Research is the Indian industrialist Gautam Adani, who became wealthier than Bill Gates and Warren Buffett combined in recent years. It is a commonly held belief that the United States is unable to adequately digest the economic expansion of other nations and, as a result, uses a number of strategies to bring down the standard of living in those countries. In this scenario, Adani is the next target, most likely with the intention of causing disruptions in India’s rapidly expanding economy. Variety of reports that are released by US and EU based research organizations more often have one sided view of rising Asian economies like China and India. Recent World Hunger Index that placed India below Pakistan and Sri Lanka was such a anti marketing that it became a butt of joke in India.

In a report that was released on the 24th of January, Hindenburg Research presented a number of charges that were categorically refuted by Adani Group, a conglomerate that is owned by Gautam Adani. The investigation made allegations that the organisation had engaged in stock manipulation, committed accounting fraud, and had accumulated a significant amount of debt through the pledging of stocks in exchange for loans. The organisation provided a response that was 413 pages long and claimed that the report was a “planned attack” on India’s progress and reputation and that it was motivated by evil motives to earn a profit for Hindenburg. The Adani Group asserted that the report lacked trustworthiness, objectivity, and research-based evidence in addition to being rife with falsehoods, omissions, and assertions that were not true.

In addition to this, Adani Group accused Hindenburg of having a conflict of interests, as well as breaking rules pertaining to securities and foreign exchange. The aim to generate money was the impetus behind the distribution of the study, which the Adani Group regarded as unethical and harmful to the stock market and other investors. According to the group, out of the 88 questions that were posed by Hindenburg, 65 had already been answered through the disclosure documents, and the remaining 23 questions are groundless claims with manufactured facts. The Adani Group has affirmed time and again that it is in full compliance with all laws and regulations, and that it is committed to performing the greatest level of governance possible in order to safeguard the interests of all parties involved. The primary goals of the organisation are to make a positive impact on the development of India as a nation and to increase India’s visibility on the international scene. The Group stated that it is committed to safeguarding the interests of its stakeholders and maintains that it retains the right to provide a further response to any charges that are raised in the Hindenburg report or any additional statements.

Let us now do a more in-depth investigation into this research company. Although it presents itself as a research and investigation firm, Hindenburg Research is not what it purports to be. Instead, it is a company that engages in short selling and generates enormous financial benefits through the deliberate theft of stocks. In the USA, the FBI is looking into the company at the moment to determine whether or not it engaged in any potentially criminal trading practises; also, the company is well known as a “Ponzi Hunter.”

The name of the company, which is drawn from the Hindenburg aviation catastrophe, Hindenburg Research, claims to protect individuals from financial calamities that are the result of human activity. However, the convictions in the United States and their track record in the past are full of questionable business operations. A quick look through the website of the company will show that there is no reference of the physical location of the business, and that there are only five people employed by the organisation.

Hindenburg Research makes a profit from the fall in the share price of a target business. The company claims that the short selling is done by its client companies, and those companies pay a commission to Hindenburg Research. The financial accounts of Hindenburg Research do not, however, include any mention of Adani stocks. Instead, the company receives its revenue from outside sources.

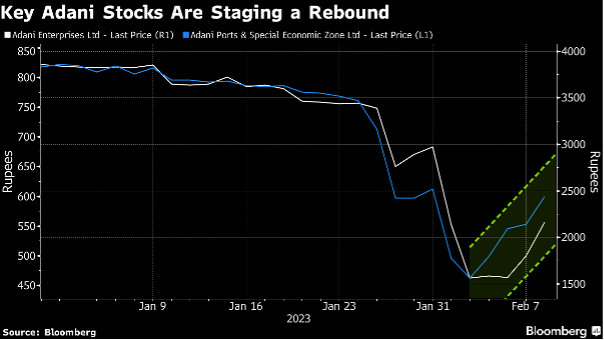

The Adani group has been impacted for now, but not damaged by what is claimed as a well-planned attack by Hindenburg Research. They have even purchased Israel’s Hifa Port for 1.2 billion dollars and even repaid $1.1 billion share-backed loan since then. The Adani group has been trying to protect its investors from the possibility of incurring financial losses, and they have been taking steps to counter the impact of such a report. After a week in which share prices fell by around fifty percent, Adani Group stocks began to rise, and on the second day of the rally, they regained twenty percent in a single day again fell when Total Energy announced pausing a deal with Adani group till the time clarity on these allegations are cleared. The Group’s share prices remain volatile since then.

Also read: Tingo Group Rejects Defamatory Allegations by Hindenburg Research

Not to remain on the receiving end, Gautam Adani-led conglomerate has hired US legal firm Wachtell in short-seller battle against US-based Hindenburg Research. The law firm is known to be fierce at activism defence.

Hindenburg Research is not a legitimate research and investigative company. Instead, it is a short-selling looter that profits through unethical securities fraud. The company is under investigation by the FBI and has many flaws, including a lack of transparency about its origin and financial reports. Motives behind such reports can be shady and even part of larger plans to derail economy of other countries. Financial reports of any listed company should be checked by approved auditors and regulators must keep a close watch on the business of any large Cap company like Adani. Such paradropping by any outsiders have potential to disrupt a growing economy of any country as it divides the public opinion with most of them blindly believing such allegations and multiplying the damage even before the real picture emerges. In this case too, a lot of bloggers and vloggers jumped the Hindenburg balloon and tried to prove why a business house like Adani is a culprit of malpractices without going deeper in this complete saga.

Even though the drama is slowly settling down, it is still a long way before Adani comes out fully clean from the allegations, but if the Hindenburg report is proven to be malicious, it will be a big lessons for every economy to be even more watchful.

Also Read Unpacking the Adani Group Controversy: True or False?

Adani’s stock performance has been unpredictable after the report was made public, with Moody’s changing its rating for three of its stocks from stable to negative, while keeping the others at stable. The regulatory authorities in India are thoroughly investigating the allegations to ensure that no unethical practices were carried out and to restore the confidence of investors in Indian companies and the economy.

But as the picture is emerging, it is indicating that Hindenburg Research report can be just a hit job conducted either for profits or it was a part of a larger conspiracy to impact fast growing Indian Economy as such. What is the truth, only time will tell.

PS: The analysis is a personal view of the author based on commonly available data.

Unfortunately this report is brimming with biasness and appears to be written by an overt nationalist. The report is questionable